Unless you can afford to pay out of pocket, finding ways to cover long term care expenses makes good financial sense. With limited assistance available from the government, long term care insurance is a popular way for many to mitigate high care costs as we age.

“It’s really important for those looking into long term care insurance to sit down with an adviser,” says Kristina Wong, Care Manager at Home Care by ALTRES Medical.

“You want to make sure that your policy covers your care preferences as well as accounts for potential changes in your health.”

What is long term care insurance?

Long term care insurance helps individuals pay for long term care and typically covers a host of services that are not covered by regular health insurance. Most policies will reimburse policyholders a daily amount for assistance with activities of daily living (like bathing, dressing, and eating) in a variety of settings, including in-home, nursing home, assisted living facility, or adult day care center.

How much does long term care insurance cost?

Insurance premiums vary depending on your age when you secure a policy, the amount of coverage you need, and your health, among other things. On average, long term care insurance can cost a couple in their mid-50s anywhere from $2,080 to $4,825 per year (Source).

See also: AARP Long-Term Care Calculator

Misconceptions about long term care insurance

Despite how many people will need long term care in the future, not very many have secured insurance policies—almost 60 percent of individuals do not have long term care insurance, according to a 2016 PlanBeyond survey.

There may be misconceptions preventing some from looking into long term care insurance. Here are just a few:

“Medicare will cover my long-term care expenses.”

It’s not likely that Medicare will cover your long term care expenses. The amount of long term care coverage provided by Medicare is limited in both time and situation. Most long-term care is not medical care, but rather custodial care—or non-skilled personal care, like assistance with bathing, dressing, eating, etc.—which is not covered by Medicare if it’s the only care you need.

The misconception may occur because many people confuse Medicare and Medicaid. While Medicare does not cover custodial care, Medicaid will—but only if you meet certain income and asset requirements determined by the government.

“I don’t need long term care insurance, my family will take care of me.”

It’s true that in times of need our families are there for us. But relying solely on your family to provide your long term care is ill-advised. For starters, your family may not be willing to take on that full-time responsibility. Caregiving can be mentally, physically, and emotionally draining, especially if they have a family of their own to look after. Furthermore, they may not be capable or equipped to provide you with the level of care you need, especially if that need increases over time.

“When I need long term care insurance, I’ll get it.”

We often don’t like to think about something bad happening to us, until something bad happens to us—fair enough. But just like you can’t insure a house once it’s on fire, the longer you wait to secure long term care insurance the greater your chances of being denied coverage. On average, only 17 percent of individuals in their 50s are denied coverage. By the time you’re in your 70s that number jumps to 45 percent (Source).

“I can’t afford long term care insurance.”

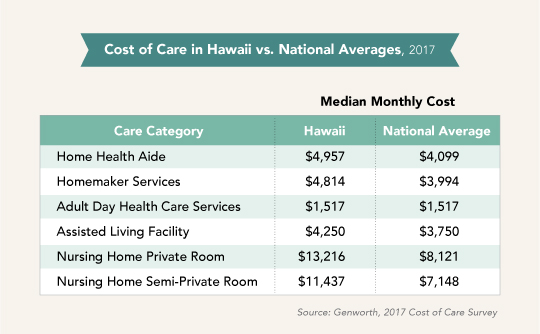

Before you assume you can’t afford long term care insurance, consider this: a semi-private room in a Hawaii nursing home will cost you roughly $11,500 a month; for a private room, almost $13,200 a month! If you’re in your 50s now, image how high those costs will be in 20 years. Not only that, but consider that the cost of care in Hawaii is well above national averages.

Don’t let misconceptions about long term care insurance prevent you from planning your long term care. Having an insurance policy may put you and your family in a place to afford quality care that might otherwise be out of reach.

If you’re interested in finding out more about Home Care by ALTRES Medical and how we can help, feel free to give us a call at (808) 591-4930 or you can request more information on our website.

Unless you can afford to pay out of pocket, finding ways to cover long term care expenses makes good financial sense. With limited assistance available from the government, long term care insurance is a popular way for many to mitigate high care costs as we age.

“It’s really important for those looking into long term care insurance to sit down with an adviser,” says Kristina Wong, Care Manager at Home Care by ALTRES Medical.

“You want to make sure that your policy covers your care preferences as well as accounts for potential changes in your health.”

What is long term care insurance?

Long term care insurance helps individuals pay for long term care and typically covers a host of services that are not covered by regular health insurance. Most policies will reimburse policyholders a daily amount for assistance with activities of daily living (like bathing, dressing, and eating) in a variety of settings, including in-home, nursing home, assisted living facility, or adult day care center.

How much does long term care insurance cost?

Insurance premiums vary depending on your age when you secure a policy, the amount of coverage you need, and your health, among other things. On average, long term care insurance can cost a couple in their mid-50s anywhere from $2,080 to $4,825 per year (Source).

See also: AARP Long-Term Care Calculator

Misconceptions about long term care insurance

Despite how many people will need long term care in the future, not very many have secured insurance policies—almost 60 percent of individuals do not have long term care insurance, according to a 2016 PlanBeyond survey.

There may be misconceptions preventing some from looking into long term care insurance. Here are just a few:

“Medicare will cover my long-term care expenses.”

It’s not likely that Medicare will cover your long term care expenses. The amount of long term care coverage provided by Medicare is limited in both time and situation. Most long-term care is not medical care, but rather custodial care—or non-skilled personal care, like assistance with bathing, dressing, eating, etc.—which is not covered by Medicare if it’s the only care you need.

The misconception may occur because many people confuse Medicare and Medicaid. While Medicare does not cover custodial care, Medicaid will—but only if you meet certain income and asset requirements determined by the government.

“I don’t need long term care insurance, my family will take care of me.”

It’s true that in times of need our families are there for us. But relying solely on your family to provide your long term care is ill-advised. For starters, your family may not be willing to take on that full-time responsibility. Caregiving can be mentally, physically, and emotionally draining, especially if they have a family of their own to look after. Furthermore, they may not be capable or equipped to provide you with the level of care you need, especially if that need increases over time.

“When I need long term care insurance, I’ll get it.”

We often don’t like to think about something bad happening to us, until something bad happens to us—fair enough. But just like you can’t insure a house once it’s on fire, the longer you wait to secure long term care insurance the greater your chances of being denied coverage. On average, only 17 percent of individuals in their 50s are denied coverage. By the time you’re in your 70s that number jumps to 45 percent (Source).

“I can’t afford long term care insurance.”

Before you assume you can’t afford long term care insurance, consider this: a semi-private room in a Hawaii nursing home will cost you roughly $11,500 a month; for a private room, almost $13,200 a month! If you’re in your 50s now, image how high those costs will be in 20 years. Not only that, but consider that the cost of care in Hawaii is well above national averages.

Don’t let misconceptions about long term care insurance prevent you from planning your long term care. Having an insurance policy may put you and your family in a place to afford quality care that might otherwise be out of reach.

If you’re interested in finding out more about Home Care by ALTRES Medical and how we can help, feel free to give us a call at (808) 591-4930 or you can request more information on our website.